Why Asset Poverty Matters

Asset poverty is defined as having insufficient net worth – this includes savings and durable assets, such as a home or business – to cover three months of living expenses without income.

It is a more complete understanding of what it really means to be living in poverty.

Poverty is about more than just income. When a family lacks savings and assets, an economic emergency – such as losing a job, or an unexpected expense like a hospital bill or car repair – is far more likely to cause serious and lasting hardship, even if the family has enough income to cover basic expenses each month. Moreover, asset poor families miss out on the opportunity to build wealth and, as one researcher describes it, “springboard into the middle class” [i] - by earning interest, building equity, or investing in education to earn a higher salary.

Yet income is where most anti-poverty programs hold their focus.

If we believe that low-income families should have the chance the build a pathway out of poverty, then we have to care about asset poverty. If we understand that poverty is a cycle that often traps families from generation to generation, then we have to care about asset poverty.

In the last decade, new research and practice have documented the importance of wealth and asset development in the fight against poverty. When families build savings and assets, children demonstrate a more hopeful and positive orientation toward the future. Asset ownership reduces the duration of unemployment, helps single mothers maintain their families above the federal poverty level, increases overall household savings and investing, and lowers a family's subjective sense of economic hardship. Asset ownership is associated with improved educational outcomes for children, including higher high school and college graduation rates, and a decrease in the intergenerational transfer of poverty.

By The Numbers:

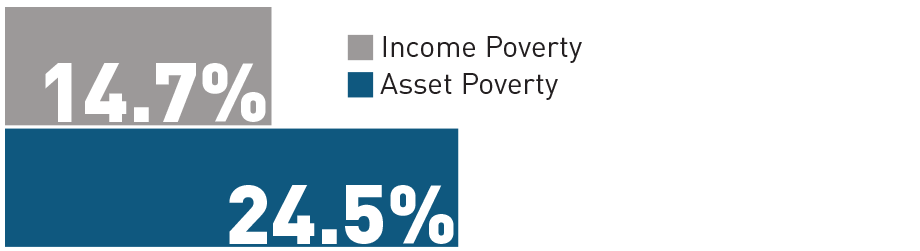

Nearly 25% of U.S. families are in asset poverty. [ii] The asset poverty rate is nearly double the federal income poverty rate. [iii]

2.2 times as many households of color in the U.S. are asset poor as compared to white households. [iv]

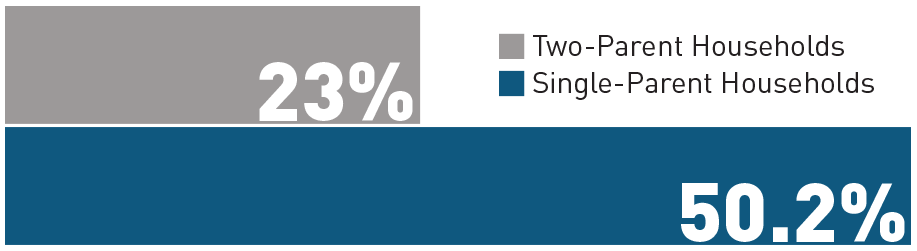

2.1 times as many single-parent households in the United States are asset poor as compared to two-parent households. [v]